Home

The Macro-Impact of the Microgrid

April 24, 2024

Smart Grid

Reimagining The Future Grid

April 17, 2024

Sponsored Content

Sponsored Content

Renewables

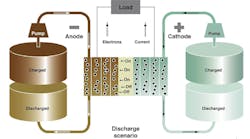

Battery Energy Storage Systems | QuickChat

April 18, 2024

Renewables

Aerial Spacer Cable in Renewables Applications

March 27, 2024

Sponsored Content

Jobs

Jobs